Background information

In the business world, consumers are highly valued as pivotal assets crucial to business success and growth. Their engagement and patronage directly impact business outcomes. Whether individuals or businesses, consumers play a vital role as the primary purchasers of goods and services in the economy. Customer satisfaction is a cornerstone of business success, influencing customer loyalty, referrals, and overall company expansion. The Net Promoter Score (NPS) approach is a highly effective method to gauge customer satisfaction. This article will dig into what NPS entails, its operational mechanics, and its significance as a business strategic tool.

Webhaptic Intelligence is a leading, independent market research agency based in Africa, known for its innovative approach and comprehensive technology-driven primary research services. We specialize in delivering actionable insights, from needs identification to implementation. Our expertise spans diverse sectors, including financial institutions, financial technology, insurance, and skin care industries, among others.

Webhaptic intelligence experience in the insurance industries

For the past three years, Webhaptic Intelligence has conducted an annual customer satisfaction survey on behalf of a prominent insurance company in Nigeria, involving a total sample size of 3000 respondents per year. Utilizing Computer Assisted Telephonic Interview (CATI) methodology, the primary objective of the study was to assess customer feedback on various products and services, particularly focusing on life insurance and general insurance offerings. The survey aimed to identify areas for improvement and gather insights to enhance customer satisfaction.

This initiative has significantly benefited the company, bolstered its market presence, and attracted increased subscriptions for its products and services. Customers have expressed satisfaction with the timely payment of compensation premiums.

Webhaptic intelligence experience in the Skincare industries

Webhaptic Intelligence agency has been tasked with conducting a customer satisfaction survey for a leading marketer in the skincare industry in Nigeria. Quarterly assessments involving a total sample size of 1500 were conducted using Computer-Assisted Personal Interviews (CAPI), employing a face-to-face approach. The insights gathered over the years have played a pivotal role in the successful launch of new products that resonate positively with customers.

Through regular feedback integration, the company continues to lead the skincare market, significantly influencing its business growth and maintaining industry leadership.

Webhaptic intelligence experience in the financial technology industries

In recent years, the financial technology sector has seen significant growth and recognition across African regions, particularly in Nigeria. The emergence of fintech has greatly simplified business transactions, benefiting Small and Medium Enterprises (SMEs) and online business owners alike. Our extensive experience in this field has enabled us to understand and anticipate customer preferences, providing our clients with valuable insights.

This understanding has helped our client maintain a prominent position among the top 5 leaders in the fintech industry. We conducted a comprehensive survey with a total sample size of 3500 across key locations including Lagos, Abuja, Kano, Port Harcourt, and Enugu, utilizing a face-to-face approach.

Webhaptic intelligence experience in the financial institution industries

The introduction of microfinance banks in Nigeria has opened up numerous opportunities, particularly in the form of business loans tailored for micro, small, and medium enterprises (MSMEs). These loans have played a crucial role in facilitating business expansion and growth across the country. Annually, Webhaptic Intelligence conducts a survey with a sample size of 1000 using the Computer Assisted Telephonic Interviews (CATI) approach.

Our clients administer various business loan programs that empower enterprises to enhance their workforce and revenue-generating capabilities. Webhaptic Intelligence was engaged to conduct a quarterly tracking study, focusing on assessing customer satisfaction with different business loan products offered by the microfinance bank.

This ongoing study has empowered our clients to diversify their offerings and develop strategic initiatives aimed at enhancing customer satisfaction. Insights gathered from customer feedback on loan usage have been instrumental in refining existing loan features and designing new ones that resonate with and attract more customers.

Net Promoter Score (NPS) Analysis:

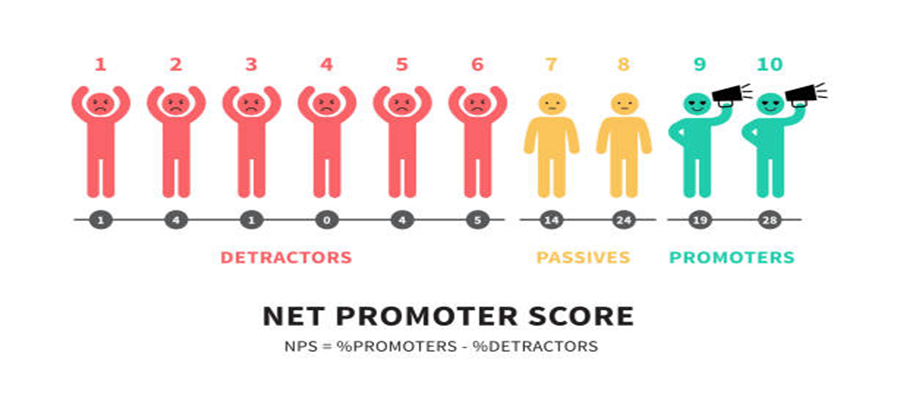

The Net Promoter Score (NPS) is a metric utilized to evaluate the loyalty of a company’s customer base, indicating both customer satisfaction levels and the likelihood of repeat business. Initially introduced by Fred Reichheld in 2003, NPS has become a widely adopted standard in businesses worldwide.

Conclusion:

The Net Promoter Score (NPS) methodology is a potent tool for assessing customer satisfaction and loyalty. Its straightforwardness, predictive capability, and customer-focused approach make it indispensable for businesses aiming to enhance customer experiences and drive growth. Regularly conducting NPS surveys and acting on the insights obtained enables companies to cultivate stronger customer relationships and achieve sustainable success.

Integrating NPS analysis with customer satisfaction surveys (CSS) has proven highly beneficial for our client’s business in fostering customer loyalty, thereby enhancing market penetration and word-of-mouth recommendations. By consistently leveraging NPS, businesses can stay attuned to customer sentiments, prioritize customer experience, and swiftly address any issues that arise.