Nigeria’s Distinct Consumer Markets

Nigeria’s grocery market has seen significant changes, both upward and a downturn in the past year, largely influenced by rising inflation and shifting consumer preferences. Across key regions—Lagos, Rivers, Enugu, and Kano—purchasing attitudes vary based on economic realities, product availability, and local production.

Our latest analysis reveals a widespread increase in grocery prices, with consumers reacting in different ways to these changes. Understanding these behaviors is important for businesses seeking to position themselves effectively in these markets.

Factors Influencing Consumer Bias When Shopping for Groceries

1. Price Increases Across Key Grocery Categories

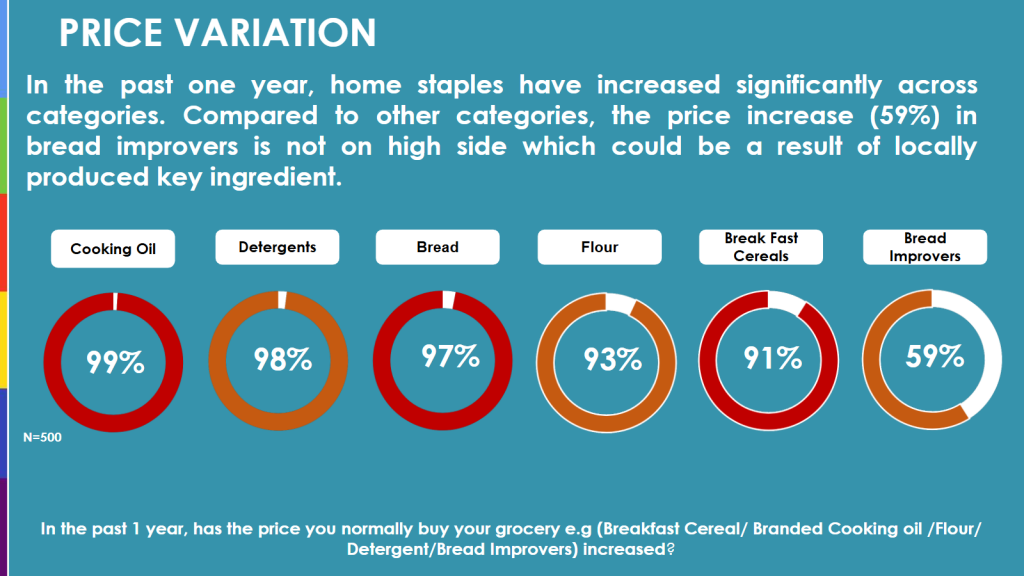

In the past year, home staple prices have increased drastically, with some products seeing nearly double their previous costs:

- Cooking Oil: 99% increase

- Detergents: 98% increase

- Bread: 97% increase

- Flour: 93% increase

- Breakfast Cereal: 91% increase

- Bread Improvers: 59% increase

Among these, bread improvers experienced the lowest price hike, possibly due to locally sourced key ingredients. This suggests that businesses relying on local production may have more control over price stability compared to those dependent on imports.

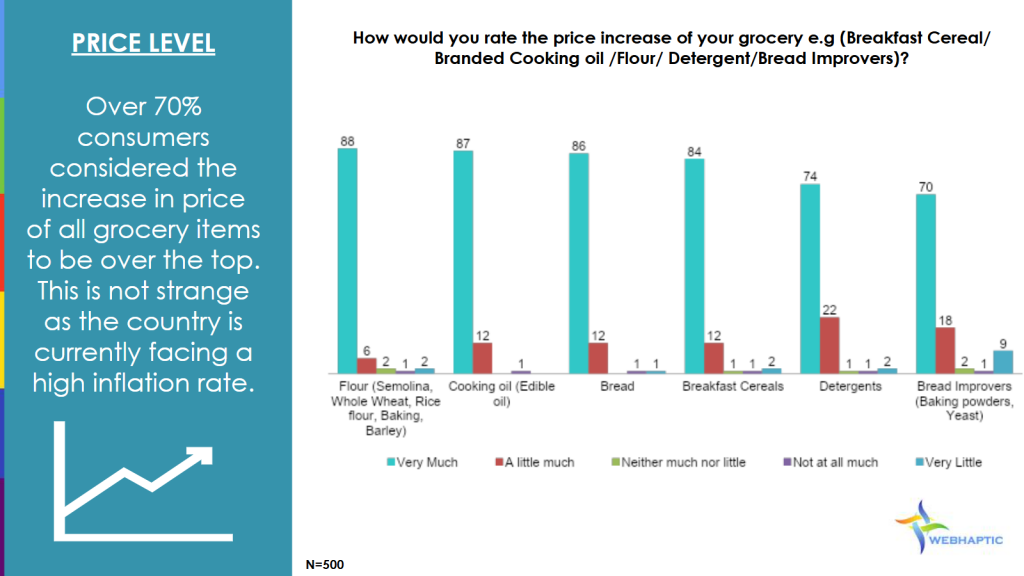

2. Consumer Perception of Price Hikes

More than 70% of consumers believe the price increases across all grocery items have been excessive, which is unsurprising given the country’s high inflation rate. However, the perception of price hikes varies across products:

- Flour: 88% of consumers felt the increase was “very much.”

- Cooking Oil: 87% considered the price hike extreme.

- Bread & Breakfast Cereals: Over 84% found the increase significant.

- Detergents: 74% rated the increase as excessive.

- Bread Improvers: 70% felt the price increase was too high, though less so than other categories.

These figures highlight the pressure on consumers, forcing them to adjust their shopping habits and seek more affordable alternatives.

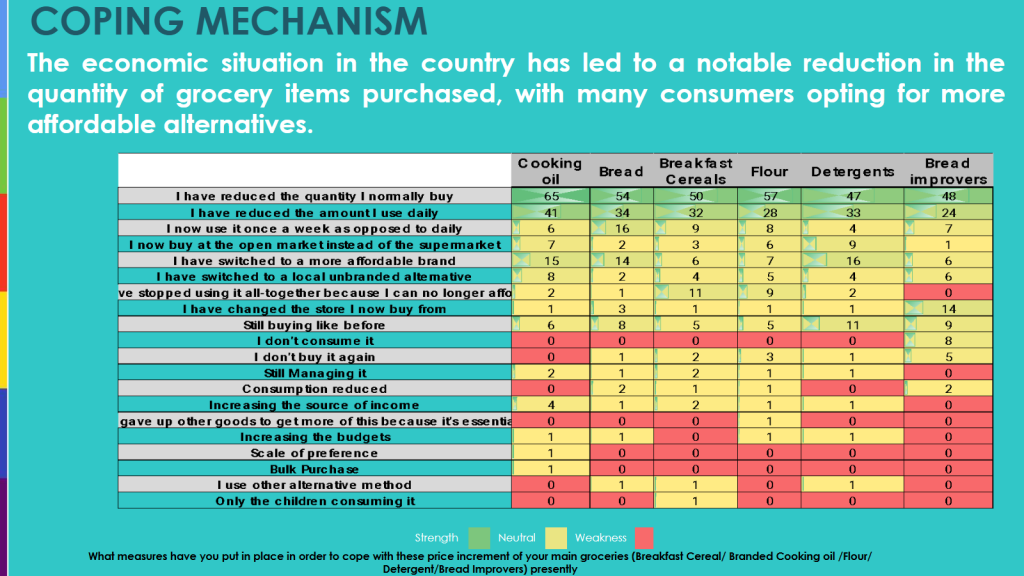

3. Coping Mechanisms in a High-Inflation Economy

As a response to rising costs, Nigerian consumers have been making significant changes in their grocery shopping behavior:

- Reducing the quantity of purchases: Many are buying less of their regular grocery items.

- Switching to cheaper alternatives: Consumers are opting for more affordable brands or locally produced goods.

- Adjusting usage frequency: Some products, like cooking oil, have seen a noticeable reduction in consumption.

For businesses, this signals an urgent need to rethink pricing strategies, offer value-driven promotions, and explore cost-effective production alternatives to retain customer loyalty.

How Businesses Can Adapt to These Regional Differences

- Leverage Local Production: The lower price increase in bread improvers suggests that local sourcing can help stabilize costs. Brands should explore ways to reduce dependence on imported raw materials.

- Introduce Value-Packed Offerings: Given that consumers are cutting back on quantity, businesses should consider offering bulk discounts, combo packs, or loyalty rewards to encourage repeat purchases.

- Regionalized Pricing Strategies: Price sensitivity varies across locations. A one-size-fits-all pricing model may not be effective. Brands should tailor pricing strategies based on consumer affordability in each region.

- Engage in Consumer Education: Informing customers about product quality, cost-saving tips, and the benefits of local sourcing can strengthen brand trust and encourage continued purchases.

As Nigeria’s grocery market continues to evolve, businesses that adapt swiftly to these shifts will be better positioned for long-term success. Understanding regional consumer attitudes and responding with tailored strategies will be key to staying ahead in a competitive and inflation-driven market.

For a full breakdown of regional consumer attitudes and detailed insights from our research, get in touch with us today. Request the complete report to stay ahead in Nigeria’s evolving grocery market.